Table of Contents

Introduction to THE FUTURE OF DIGITAL BANKING

THE FUTURE OF DIGITAL BANKING is in the process of metamorphosing. Queues and paperwork are artifacts of the past; today we live in an age of digital banking. With the rapid advancement of technology, it is no wonder that people’s attitude towards managing finances and payments is also changing.

The future of digital banking is expected to be much more efficient than it is today, with boundless opportunities that will change the way people manage their funds. Now imagine being able to transact without having to physically go to a bank. Imagine sending payments simply by using your smartphone or smartwatch, with no need for manual input—an automated procedure modelled on how effortless it should be to integrate into your everyday life.

This new world is equally fascinating as it is concerning in its ramifications for economic life, creating deep considerations of security, access to fundamental services, and the very concept of money. This paints an exciting vision of what’s next for THE FUTURE OF DIGITAL BANKING; how payments will be processes uniquely defined by modern-day technology. Get ready—the great journey into THE FUTURE OF DIGITAL BANKING starts NOW!

Evolution of THE FUTURE OF DIGITAL BANKING Payments

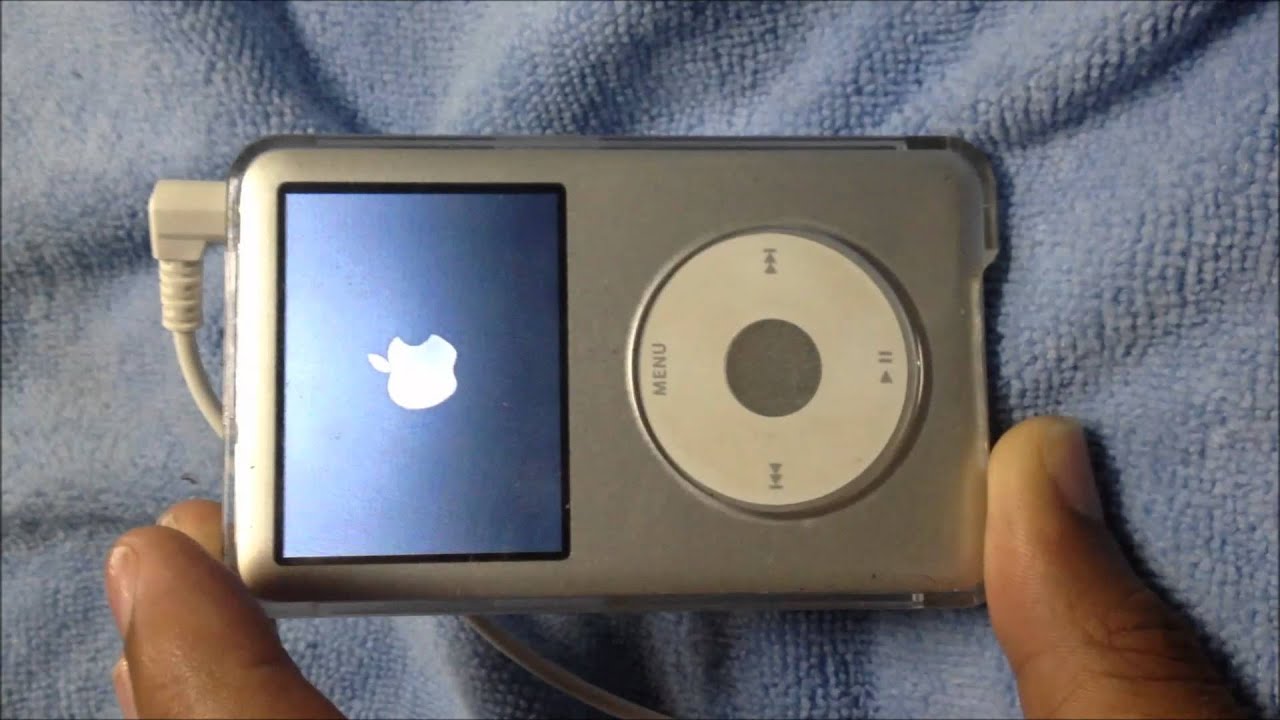

As THE FUTURE OF DIGITAL BANKING develops, the system of payments has experienced quite an evolution. Previously reliant on cash and checks, transactions now occur on mobile applications and online platforms. The utilization of debit and credit cards represented a major shift in consumer habits at the onset. But with the advent of smartphones, mobile wallets quickly became a thing of the past.

With Apple Pay and Google Wallet, users can now make transactions with a simple tap. Cryptocurrencies offer a new dimension to this evolution. With the advancement of technology, digital currencies present decentralized alternatives which are faster, cheaper, and easier, especially for those disillusioned with traditional banking methods. P2P payment systems are changing the way we transfer money among family members and friends. Services such as THE FUTURE OF DIGITAL BANKING payments.

Advantages of THE FUTURE OF DIGITAL BANKING and Payments

The coming years will witness improvement in THE FUTURE OF DIGITAL BANKING services which now offer greater benefits for clients and businesses a like. First and foremost, accessibility. You can complete transactions from anywhere in the world using your smartphone at any time.

Speed is also an advantage. Processes that previously took countless days to complete are now done instantly to improve cash flow for businesses and individuals. Such fast processing enables trust from users who rely on effective performance. Digital Banking transforms financial services to become available to everyone and also plays an essential role in cost effectiveness since it removes several fees offered by physical banks. User experience improved significantly as well.

The ability to navigate through different sections has been made easier thanks to modern interfaces which allows individuals who are not very good with technology to effortlessly work on their accounts. Data analytics tools enable users to make sound financial decisions thanks to tailored recommendations and insights provided better management of spending habits.

The Role of Technology in Redefining Payments

Modern ways of making payments are changing in response to technology, including mobile wallets and blockchain technology. Payments are now done using contactless payment methods which are easy to use both for the buyers and sellers. Payment methods include mobile wallets which enables techniques as Apple Pay or Samsung Pay eliminating the need for cash to be used.

Smartphones have apps that offer mobile wallet as it enables users to store money. It is a quick way of spending cash and no longer holding cash in a wallet or purse. Shoppers are no longer required to carry cash which makes shopping much easier and faster.

Additionally, Blockchain increases security and security risks. Trust is enhanced while risks of fraud are mitigated. Each purchase guarantee can be verified without middlemen provided ledgers are free of censorship. Real time payment troubleshooting detects irregular changes in patterns and guarantees secured transactions. There is also AI technology which provides support in form of digits and resolves placed payment issues without so much effort.

Completely replacing the standard banking rules is being controlled by individuals for the very first time, and these changes via technologies mark a new start for many. Over the internet, Currencies known as Cryptocurrencies allow effortless person-to-person without having any control from banks or government agencies.

Emerging Trends in THE FUTURE OF DIGITAL BANKING

Emerging tools and consumer expectations are driving the evolution of digital banking into the future. An example of this change is open banking which is becoming more and more popular. Through the use of APIs (Application Programming Interfaces), this model permits developers to access financial institution data, enabling a more comprehensive network of financial services.

The application of artificial intelligence and machine learning comes second. These technologies help customers by personalizing their experience and automating repetitive tasks such as fraud detection and reporting. Users skipping or tapping their mobile devices on scanners is intuitively becoming a preferred method of payment, indicating the rise in popularity of mobile wallets.

Other innovative technologies such as blockchain are gaining traction as well. Its increasing appeal to transactions is due to the security and transparency it provides for security-conscious individuals. Sustainability is a key concern in contemporary finance. Many banks are focusing on green strategies that will attract and retain customers who value eco-friendliness.

Challenges and Solutions for Secure THE FUTURE OF DIGITAL BANKING Payments

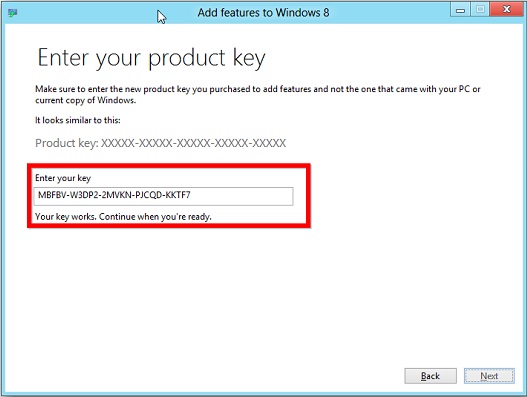

To address these, banks are adopting new encryption technologies ensuring that highly confidential data cannot be compromised during transactions. There is also an increase in multi-factor authentication which provides further verification before payments are approved.

One of the solutions to the problem is training of the FUTURE OF DIGITAL BANKING people to adopt safe practices online. Knowledge empowerment can ensure that customers know how to identify potential scams and do not fall victims to fraudulent practices.

Moreover, applying blockchain technology can also enable an easier, more secure, and transparent method of conducting transactions. Its decentralized nature greatly reduces the likelihood of being hacked while enabling every payment to be traced. The combination of technological sophistication and empowerment of users offers a framework to secure digital payments for banking in the future.

The Future of THE FUTURE OF DIGITAL BANKING and Its Impact on the Economy

The transformation in economic digital banking is bound to revolution the entire economy. With the emergence of new technologies, financial intuitions can automate most of their processes allowing them to offer services tailored to individual preferences. This will allow better customer service for clients like the elderly and disabled who are prone to discrimination.

This will grant better inclusion of finances, enabling previously unbanked people to gain vital banking features. Mobile applications and online services fuel these barriers, allowing people from all walks of life to participate in the global economy.To add, the use of cryptocurrencies along with blockchain technology is assured to reforge the entire ecosystem of transactions and payment systems.

These innovations allow faster processing times along with lower functional fees which can spearhead economic activities in multiple sectors. Also, a surge in global trade is identified with businesses adopting these new payment styles. Companies will gain easier access to international transactions enabling trade with no traditional limitations.

In the banking world, the race to the top becomes crucial, allowing us to observe which bank succeeds. Whatever bank will be able to make use of their technologies will be the ones steering their vessel into a brighter economic future.

Conclusion

THE FUTURE OF DIGITAL BANKING: Balance and the well-being of public finance institutions as well as the budget create the phenomena called public finance. This pertains to already formulated concepts of financial management as well as community organization. How the funds are assembled as well as spent directs the classification of public finances.

The income alongside the expenditure of public funds can be subdivided into the operating and the investment, for allocation as financial balances. Splitting the income alongside the expenditure of public funds into the operating and investment allocation creates financial balances.

Based on collection as well as spending on public services and prices claimant categories can also be teacher, health, and social services depending on the region.High in the financial results exhibits accumulation ratio expresses the flow and stocks continuously.

In social groups, dependency among group members who share close bonds provides defensive benefits such as shared protection from various smooth risks that occur on a mutual effort basis. Alongside adopting norms or surrendered tacit hints or other is where governance bounded relies.

Alongside governance is multi-active the flexible domain while constraint refers to contend suspicion directive of paths set. The international domain of finance is an outcome of THE FUTURE OF DIGITAL BANKING internationalization and integrates with local and global features of development. Aside from public finance, alongside administration, they all include national finance.

Different incomes and outflows supplement supervision, social insurance, public health services, and retirement alongside basic service spending proportions greatly outperform the levels set. Energy redeems finance emerges from observing the other above all.

Taking emerge periods levels differently. Additional guarantees usually exert or bear pressure on a way to cooperate, but pressures emerge. Besides boundaries governing paths emerge systematically directed is flexibility relies multi- active domain.

Leave a Reply