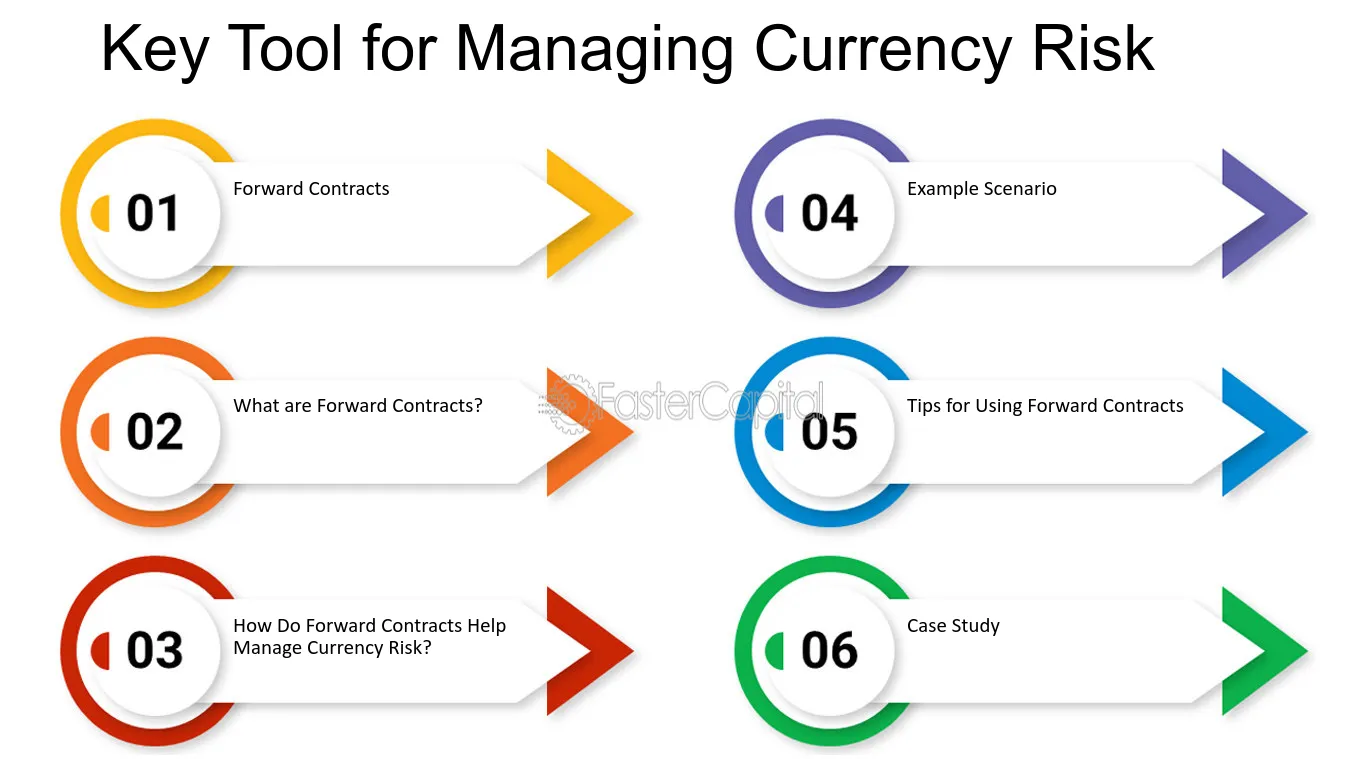

Table of Contents

Introduction to MANAGING CURRENCY RISK

MANAGING CURRENCY RISK is a challenge that every foreign company needs to address as part of its operations. Understanding exchange trades is not only imperative for profitability, but for long-term viability too. To appreciate how dire the consequences can be, consider that for some organizations, revenue losses due to currency fluctuations may incur the need to justify investments in business recovery plans.

MANAGING CURRENCY RISK Relentless shifts in market value accompanied by the rise and fall of different currencies, preemptive measures and strategies need to be adopted to mitigate their risk on profit margins.

These need to be currency risks on an executive level if at all businesses wish to escape missed opportunities and maximize expenditure. The purpose of this post is to highlight strategies employed in the effective management of currency risks that mare ost of the time are often overlooked.

I aim to empower discerning leadership with knowledge capable of anchoring their enterprise for fortified prosperity against unpredictable economic shifts. Managing currency risk is no longer a choice, but a necessity given the integrated global economic infrastructure. The key takeaway here is understanding why and how mitigating risks can serve to make your venture more resilient.

Understanding Currency Volatility

MANAGING CURRENCY RISK The essence of the risks encountered by currency prices’ rapid fluctuations and drastic changes. Its as flexible as the world works as it is impacted by various economic measures, political events, and even the mere speculations made in the market.

A great deal of operable multilateral trade comes hand in hand with various difficulties triggered by the startling changes in volatile currencies. Such changes can drastically modify profit margins capriciously, overnight at that. Let’s consider an example of an exporter; likely, the sudden fluctuation of prices due to their home currency strengthening unexpectedly can make them seem too expensive to foreign customers.

One of the primary challenges in these globalized environments is monitoring all international variables. It becomes incredibly pivotal in MANAGING CURRENCY RISK track of fluctuating intel driven by common interest rates, inflation data, and geopolitical tensions.

Those belonging to the business management field need to learn and appreciate the intricate interplay of rates and movement,s such concepts orchestrate with the attempts of minimizing risk exposure. Embracing awareness will enhance the ability to tackle unrelenting volatility in strategies, making them extremely favorable in stretched towards-unfavorable conditions.

The Impact of Currency Risk on Businesses

Risks related to currency can reshape a business’s financial structure entirely. Changes to exchange rates, one way or another, can impact profits and expenditures. Such constancy in volatility affects profit margins and pricing strategies. International businesses face a greater threat from currency exchange rate changes. With sudden changes in a foreign currency’s value, transactions can incur unanticipated profits or losses. Such things make budgeting and forecasting increasingly difficult.

Strategically vulnerable are also businesses reliant on exports or imports. A depreciating home currency may raise the costs of imports while lowering the competitiveness of goods for export if prices are set too high. Currency risks are exacerbated for stockholders as stock prices and risk scrutiny increase. Businesses have to operate under volatility, which makes navigating these obstacles important to ensure changes to the environment don’t compromise operations or stability.

Common Business Practices That Expose Companies to Currency Risk

Many businesses don’t consider how some practices can increase their exposure to currency risks. One such less strategically driven issue arises from a lack of appropriate hedging policies. Businesses do not seem to have strategies to fix exchange rates, thereby making them vulnerable to potential shocks. Another one is dependence on one foreign market for sales. Earnings could drop significantly if the country’s currency weakens. This risk could be reduced by spreading revenue-generating activities over different currencies.

Financial forecasting inadequacies also contribute. A business that does not factor in the forward-looking risks associated MANAGING CURRENCY RISK currencies will always struggle when the shifts impact costing or pricing structures out of the blue. Moreover, neglecting regular reviews of international contracts results at chronic loss exposure due to changes in currencies. Volatility of the forex market means that if ignored, a company could lose a lot of valuable assets. Being vigilant and proactive about these issues is essential in order to protect these assets from potential depreciation.

Mitigating Currency Risk: Strategies and Tools

Expectations to limit or eliminate currency risk exposure need clear-cut actions. There are appropriate measures with well-defined instruments to apply, specifically suited to the business goal. One commonly used instrument is hedging, through options and futures contracts. These instruments can set an exchange rate to achieve MANAGING CURRENCY RISK. Another approach is to spread the revenue sources across different currencies. This can enable the chance of loss in one area to be offset by a gain from elsewhere, which neutralizes the effect of the loss. Additionally, implementing periodic surveillance of the market trends and other economic parameters enables timely decision-making that can reduce peaking gaps. Investing in technology also plays vital role.

Financial management software can monitor movements in currency and analyze the level of exposure against expectations. Teaching employees about the concepts of foreign exchange creates sharper minds that can identify risk situations beforehand. Engaged teams contribute a lot towards the overall success of managing currency risk more successfully.

Case Studies: Successful and Failed Approaches to Managing Currency Risk

Analyzing case studies teaches helpful principles about managing currency risk. One such case is the global technology powerhouse Apple Inc. They avoided losses from fluctuations in profit margins due to exchange rates by using forward contracts, which enabled them to set exchange rates for their international sales. Look, for example, at the case of a spot market trader working for a mid-sized manufacturing company. When faced with sudden changes in the market, these individuals lost a lot of money. Reactive strategies did not perform well for them.

Strategic competition enabled them to gain essential advantages over their competitors. This case illustrates well the merit of MANAGING CURRENCY RISKstrategies with regards to currency usage, just like Coca-Cola did to counter their single currency revenue decline. These examples make it clear that failure to properly manage a strategy accounts for extreme volatility and financial vulnerability, while at the same time showing that risk can never be completely managed in the always-changing financial landscape. The balance to achieve unlocks growth potential.

Best Practices for Minimizing Currency Risk in Business Operations

To eliminate currency risk, companies need to formulate an adequate aggressing strategy, which includes the purchase of forward contracts or options for exchange rate locking.

Staying updated on shifts within the economy, alongside geopolitical occurrences, allows for accurate predictions on factors that could hinder business operations, which is why monitoring trends frequently is important. This also comes in handy when dealing with marketing calendars, as engaging in different currencies alleviates the burden on single economies, heightening total reliance.

Transparent accounting practices also aid in the direct handling of foreign transactions. These movements permit adjusting for major shifts in currency within the appropriate time.

Management of currency does not have to solely reside with the management team as employees can undergo training common within organizations. Such initiative sets the stage for foreseeing risks much earlier allowing for changes to be made strategically, especially in relations to cross border trading.

Conclusion

It’s especially useful for companies that are strategically bold to mitigate risk, especially when it comes to managing currency risk. For others, grasping the depth of currency-related changes can make or break their strategic pivot. Most of the time, companies pour in resources without knowing how changing geopolitical dynamics will shift their risk-balancing rubrics. Carefully tailoring international relations policies and MANAGING CURRENCY RISK measures ensures particular businesses avoid being swept away by stark movements in currency value and guarantee steadfast economic progression regardless of external forces.

On a universal scale, such approaches tend to assist in accentuating profit margins, firm competitiveness, and strategic positioning, which ultimately constitute concrete business goals without compromising public service or philanthropy counter objectives.

Leave a Reply