Table of Contents

Introduction: PROTECTING YOUR INVESTMENT

Investing can often feel like a game of poker where every decision made can either yield an immense reward or a massive loss. With the very dynamic nature of today’s world, ensuring the safety of your PROTECTING YOUR INVESTMENT has become crucial. In this context, timing becomes important; whether there is a lot of success or failure can depend on this crucial parameter.

Knowing when to place trust in a certain market makes all the difference in effortlessly cruising or struggling to stay above water. By the completion of this discussion, you will fully understand how turning point detection, along with recognizing market cycles, can be used to your advantage. You will learn how to safely and easily navigate turbulent markets with the help of maintaining long-term goals.

Emotional investing tends to block out logic, and effective timing can bring sanity back to the process. Regardless of whether one is a novice or a professional in the investing world, understanding how timing can make or break an investment is key to ensuring protection for all one has built. Allow us to guide you through these unsecured yet crucial pillars.

Understanding Market Cycles and Trends

Recognizing market cycles is necessary for safeguarding your investment. Each cycle has two distinct phases that help paint a clearer picture: upcycle and downcycle. The expansion phase takes place when growth is experienced in employment and consumer spending. This positive shift in economic indicators leads to optimism amongst investors. It is extremely important to stay watchful as the peak approaches, as overvaluation can dangerously set in.

Identifying the correct point of peak is quintessential to avoiding losses. Extreme value depression is a unique investing opportunity that contrarian zealots see during the recession phase. Staying disciplined and true to your strategy during contraction yields insane benefits down the road. Loss aversion, hyphenated with extreme pessimism, triggers extreme low pricing, which is the trough. In reality, this is the ideal time step for smart long-term investors with foresight.

Strategies for Navigating Market Volatility

The stock market is ever-evolving but remains very unpredictable and can often feel like a rollercoaster ride. However, you should not be whisked away by the shock waves. One strong method of investing is knowing when to use the dollar-cost averaging strategy. This is the method where the investor segregates a particular sum of money and spends the money regularly regardless of the market conditions.

A set goal needs to be determined beforehand as well, which will give the user a sense of clarity, which keeps them ordering through difficult and overwhelming periods. Follow your strategy to avoid counterproductive decisions made out of sheer panic. Utilize stop-loss orders as well because this tool enables you to set your own predetermined selling prices for certain assets, which aids in loss mitigation as well as providing peace of mind.

You should always make use of the ever-evolving world trends, regardless of being too fixated on the everyday ones. Rigidly go about the changes made in the portfolio, which should not be as impulsive as fear or excitement. Flexibility is extremely important as well to fully protect your investment, whilst in any and every climate.

The Impact of Emotional Investing on Timing

Investing Based on Emotion is Risky Behavior investor is prone to make decisions based on emotions, whether the market is doing well or poorly. This is especially true when the market is uncertain . When The Markets SurgeWhen the market is riding high, the investor can impulsively purchase more due to excitement. Oftentimes, most investors tend to follow the tide without properly understanding the value that they hope to attain.

During Market LowsMarket dips can be even more dangerous as most investors feel inclined to cut their losses, resulting in senseless sell-offs. These actions, in the long term, disrupt long-term recoveries that would allow for steep percentage growth. Seeing the Bigger PictureMaking decisions based on one’s emotional state can result in lapses of logic that can be catastrophic in the long run. Moreover, these actions can hinder long-term goals and milestones.

The Need For Moderate EmotionsInvestors should showcase self-discipline and put focus on emotions such as anger or stress, as anger coupled with stress can severely fog the brain and push one towards overcoming urges that could potentially put their financial situation in a dismal state.

Long-Term vs Short-PROTECTING YOUR INVESTMENT: Which is Better?

There’s a lot of debate when it comes to the clash between long-term and short-term strategies for PROTECTING YOUR INVESTMENT. Each technique has its benefits that can shape one’s financial future. Different types of investment vehicles follow different strategies, and each has its advantages. Long-term investing is often used with compounding interest or includes holding an asset for an extended duration of time.

During such time, compounding interest and growth help add value. The stress of day-to-day fluctuations in the stock market is significantly reduced. Some traders prefer short-term strategies for investing. It focuses more on rapid analysis for making decisions, which leads to profit. High adaptability is required to ensure that investment is made at the right opportunity.

With time and knowledge of variables such as risk level and stress tolerance being important for selection of the most suited strategy focused on, the personal financial goals play a pivotal role in selection. Many seasoned investors invest in both assets to maximize their returns while effectively safeguarding their finances against unexpected phenomena. These needs emphasize the importance of balanced navigation in this complex landscape.

Diversification and Risk Management as Factors in Timing

Diversification is arguably one of the primary strategies when it comes to the timing of your investment. Allocating your investments in different asset classes, industries, or sectors protects you from the major losses that can happen from one investment. This strategy enables you to stay afloat amid unpredictable market conditions.

Having risk management enhances diversification by allowing you to assess how much volatility you are willing to endure. Having guidelines for every investment mitigates emotional trading and reckless decisions when markets decline. With a robust strategy, timing becomes manageable. You will not be forced to act on impulse; instead, have a strategy with well-laid-out instructions based on market conditions, free from fear and greed. Combining risk management and diversification leaves investors equipped with the competency to maneuver unstable market forces, all while maintaining a focus on sustainable growth in all conditions.

Tools and Resources for Better Timing in Your Investments

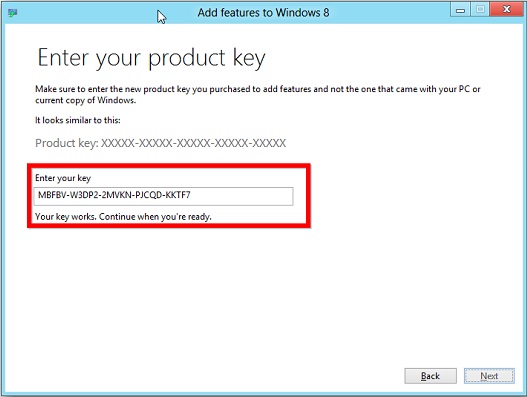

To invest successfully, the right resources are crucial. Some tools can help strategize execution for precise timing. Platform trading tools such as TradingView give access to real-time data and charts. This functionality allows investors to track changes and make prompt decisions in a short time frame.

Calendario Economico aids in keeping track of earnings reports and other economic indicators that could influence the stock marke,t as they help to update you in real time. Automated investment management is offered by robo-advisors for those seeking a hands-off strategy. These services manage portfolios based on market conditions, ensuring timely investment adjustments without continuous monitoring.

Mobile applications provided by stockbrokers should not be forgotten. Alerting systems are easily accessible and user friendly when it comes to portfolio changes which help users promptly act at the right moment. Fast reacting skills can be learnt through various webinars and courses, increasing the ability to take the right moment and seize opportunities.

Conclusion: The Key to Success in Investing Lies in Timing

In the domain of investing, timing is nearly always an overlooked aspect, yet it plays a crucial role. Timing could mean the difference between facing heavy losses and receiving remarkable profits. Severing your emotional responses, personal market cycles, and personal market trends is crucial for enhancing investment intuition.

Acquiring effective methods to manage volatility will allow you to make informed decisions during periods of uncertainty and strife. Carefully balancing short-term opportunities with long-term visions requires additional foresight and strategy.

In addition to shielding against risks, broadening the scope also boosts effectiveness measures dealing with risk management during unfavorable financial periods by offering numerous paths for advancement. Further empowering investment plans using sharp timing tools and resources creates stronger results.

Focusing on protecting your investment enables you to tailor contributing actions with time to profound changes across dynamic economies, creating a path toward achieving long-standing success. Heightened focus on shifts, alertness to market conditions, and system features workshop towards increasing payable dividends as time progresses. Radical impacts of being spot on hold or act determine enduring wealth built through chosen sound investments.

FAQs:

Why is maintenance important?

It helps in PROTECTING YOUR INVESTMENT.

Do warranties matter?

Yes, for PROTECTING YOUR INVESTMENT.

Why get insurance?

It’s key to PROTECTING YOUR INVESTMENT.

Is cleaning necessary?

Absolutely—it’s part of PROTECTING YOUR INVESTMENT.

Does quality affect value?

Yes, it helps in PROTECTING YOUR INVESTMENT.

Should I keep records?

Yes, for PROTECTING YOUR INVESTMENT.

Are inspections worth it?

Yes, they aid in PROTECTING YOUR INVESTMENT.

What about proper storage?

It’s vital for PROTECTING YOUR INVESTMENT.

Why monitor performance?

It helps in PROTECTING YOUR INVESTMENT.

Is upkeep really needed?

Yes, it’s essential for PROTECTING YOUR INVESTMENT.

Leave a Reply